Sometime in October, 2024 KCB Bank’s data migration went awrily wrong as a lag in data update allowed customers to withdraw more money than was in their accounts.

After the migration was done, clients had withdrawn nearly a billion shillings in overdrafts.

Now the bank is struggling and has capped withdrawals.

READ: Family Bank to pay duped client Sh67 million

Last week, clients complained that they couldn’t withdraw more than Sh100,000 from their accounts.

This week, the allowed withdrawals are capped at not more than Sh60,000.

KCB wanaulizwa why OTC withdrawals have been capped to KES 60,000 wanaanza kusema they are reaching out to those asking via DMs yet the question has been asked publicly

KCB what is so difficult in explaining?

Mnajua design mnatubore ama?— Tax Avid (@JaneIrunguKE) November 16, 2024

What was intended to be an exercise to improve customer experience in terms of faster transactions, through cloud based data systems has now turned into a nightmare for Kenya’s biggest bank by assets, deposits, and market share.

My client went to China early this month and he noted this week that his KCB account digital transfer has been capped to KES 50,000 daily yet he travelled to China to go and procure some machinery he called me yesterday very frustrated that he has booked a flight to come back… https://t.co/xPNFsYqBCi

— Tax Avid (@JaneIrunguKE) November 16, 2024

The loss of approximately Sh985,600,000 doesn’t sit well with the accountants and thus the rafts of measures that are putting the clients on the edge.

Hackers and poor systems

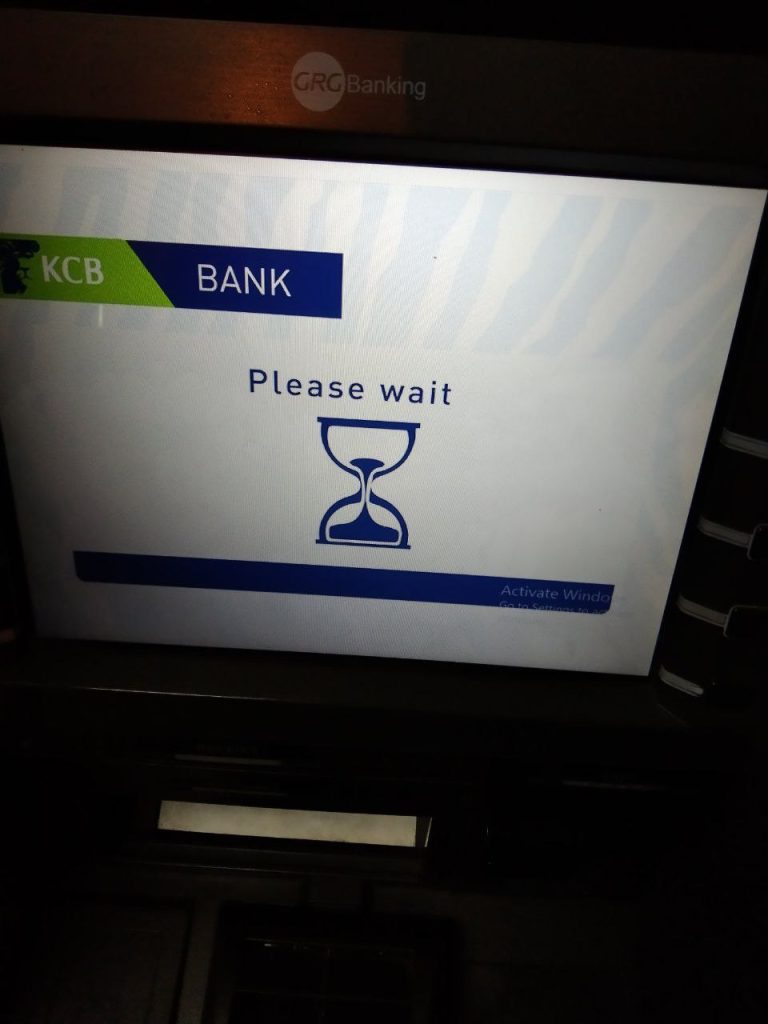

In 2021, a client noticed something with KCB Bank Automated Teller Machine (ATM).

The ATM was using a pirated Windows software, putting shame to a bank whose networht could afford it original software.

It raises a red flag when you see a bank like @KCBGroup refusing to reply a general public query on a public platform where the query has been raised, then it becomes a red flag.

I just hope none of my friends or family have their money there because it’s gonna be on fire like…— Kikuyu Pipes (@DrKanyuira) November 16, 2024

Cybercrime has been on the upward trend in Kenya. According to the Economic Survey 2023, between 2021 and 2022 cybersecurity advisories increased from 8.0 million in to 13.7 million in 2022 with hackers setting sights on large organisations.

“The increase may be attributed to the sophisticated and dynamic nature of cyber threats. The total number of reported online crimes reported more than doubled from 339.1 million in 2021 to 700.0 million in 2022,” Kenya National Bureau of Statistics said in the report.

Sahi KCB huwezi withdraw above 60k per per day.

Economy ni mbaya by next year tutakua na limit ya 20k. Fungeni mikanda.— Book Ten (@Bookten8) November 16, 2024

A 40 year old bank customer akitoa 45% of his banking business from benki moja hadi nyingine inaashiria nini mabibi na mabwana? pic.twitter.com/ipuOg5JKWI

— Jumuiyan (@Mkenyanese) November 16, 2024