Cooperative Bank of Kenya (Coop Bank) opened a branch in the congested Umoja Estate in Eastlands Nairobi so as to make it easier for their clients in the estate to transact easily instead f going all the way to Buruburu, Kayole or Donholm estates.

However, the tier 1 bank, the third-largest in terms of asset base has not been true to that promise as per resident of Umoja Estate who have interacted with it.

‘Long lines characterize the banking halls with only two cashiers serving the whole lot while the other slots are empty’, complained a client of the bank in Umoja.

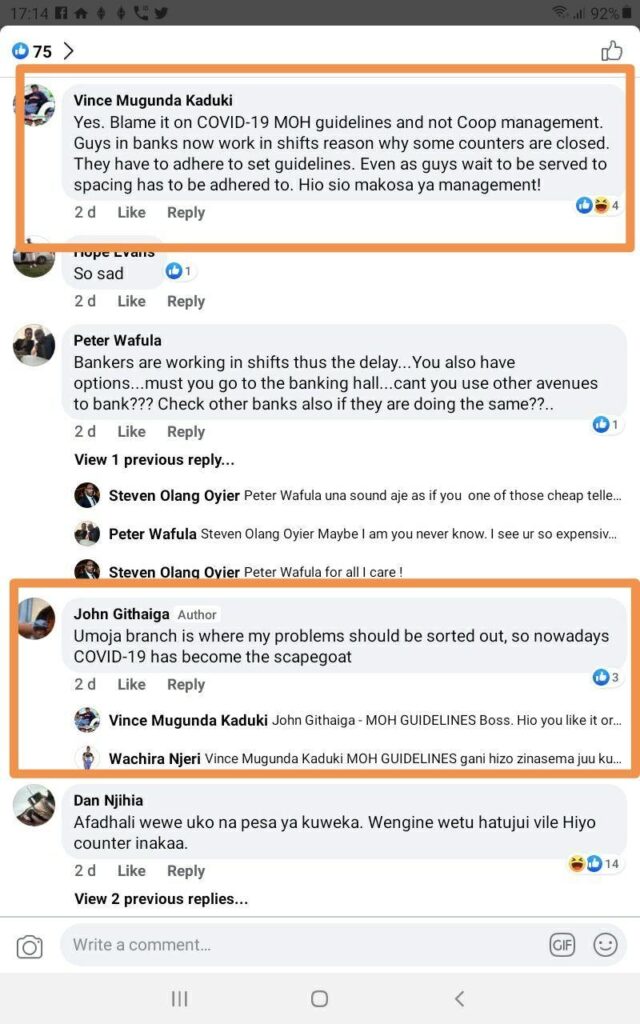

In the Covid-19 era where people are supposed to social-distance, residents complain of being kept lining longer in the scorching sun since the ‘bank has not improved on the cashier numbers’.

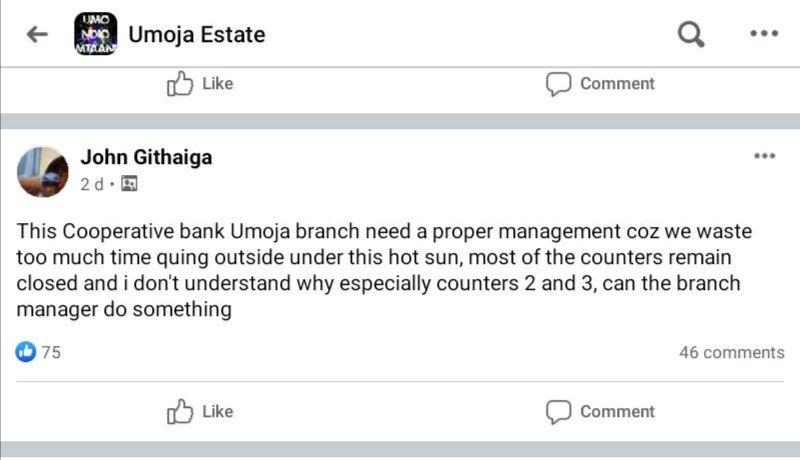

In a Facebook post in the Umoja Estate Group, a user posted the issue, ‘This Cooperative bank Umoja branch need a proper management coz we waste too much time quing outside under this hot sun, most of the counters remain closed and i don’t understand why especially counters 2 and 3, can the branch manager do something”, John Githaiga wrote.

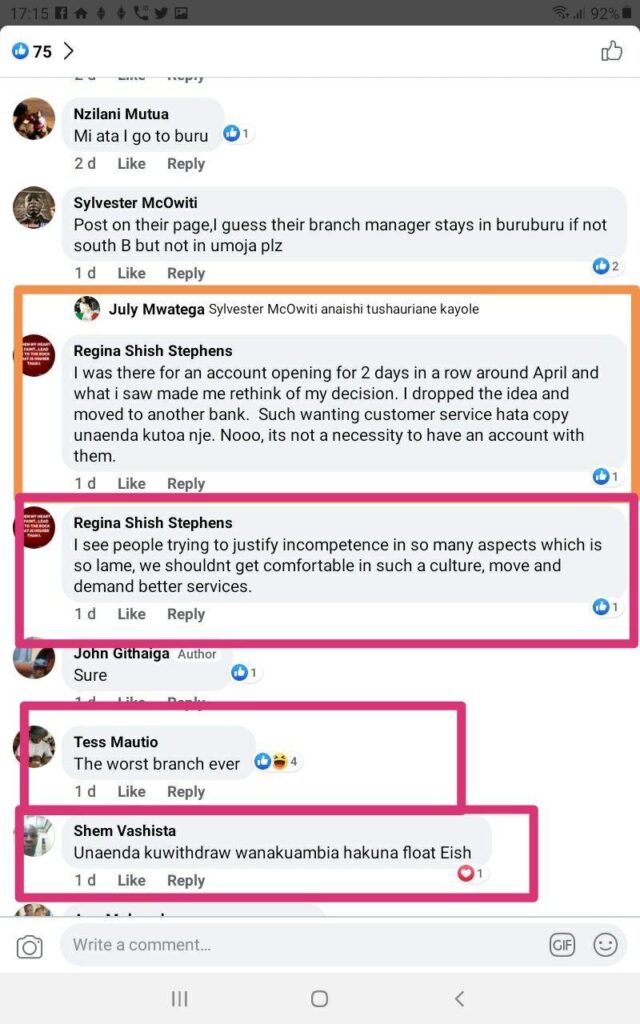

Other group members jumped in to offer their advice; some shared their experience with the bank.

Cooperative Bank acquired Jamii Bora Bank and rebranded it to Kingdom Bank, a name change that was approved by the industry regulator Central Bank of Kenya (CBK).

The Bank’s profit dropped 3.6 per cent to Sh7.2 billion on account of higher loan loss provisioning in a Covid-19 environment.

Net interest income grew by 12 percent to Sh15.9 billion from Sh14.3 billion posted in the preceding similar period to keep the bottom-line steady despite a five percent retreat in non-interest income to Sh8.3 billion.

Co-op Bank Group CEO Gideon Muriuki termed the performance strong, even as the lender raised the loan loss provision by 57.9 percent to Sh1.87 billion, from Sh1.18 billion.