Cooperative Bank of Kenya was this morning forced to drop charges on its MPESA to bank money transfer.

It started after a client complained about the high fee charged on the bank’s mobile banking app.

‘Why deduct money from our accounts in the name of ledger fees without any notification. What kind of customer service do you have?? Shame!!!”, a Twitter user David George asked.

To which the bank replied, affirming the Sh35 charge.

Another Twitter user chided, ‘Therefore this not where to open a chama account. For 20 members you spend 700 per month on ledger fee. That’s 8400 per year. Thanks for the info”.

Coop Bank was at pains to explain.

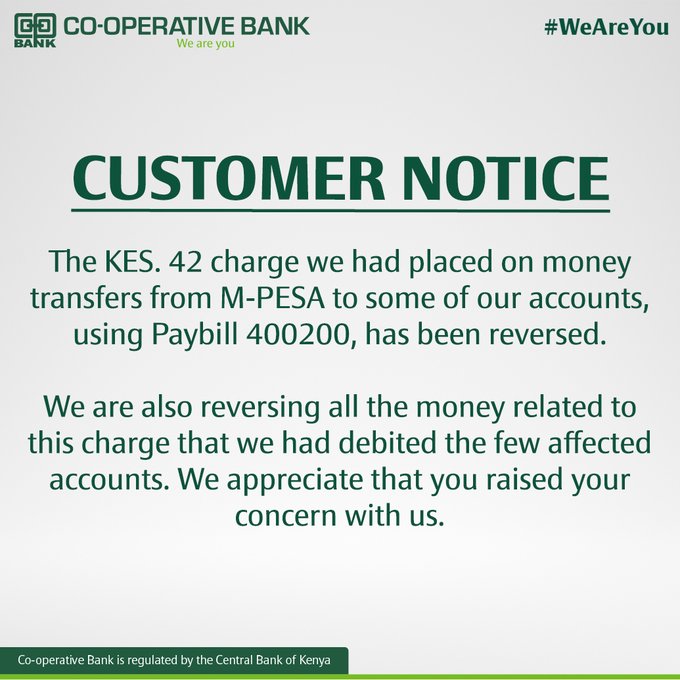

This morning, the bank said it has waived the fee and will credit some selected accounts where money was deducted.

“We wish to advise that we will no longer charge the ledger fee on mpesa to account deposits”, Coopertaive Bank wrote in a brief statement accompanied by the below photo.

This brief exchange opened a pandoras box as Kenyans on Twitter – KoT, flooded the Twittersphere with similar message, not only, protesting Cooperative Bank’s exorbitant charges and poor online services but other banks too.

@FauluKenya charge 360/- to reactivate account and 240/- to get a loan statement ?

— Outdoorsy?? (@staxx_transit) March 3, 2022

National bank charges 10 bob to view the balance

— ✦ ˚ ?Ancient One? ˚ ✦ (@Dei_Prometheus) March 3, 2022

Even enquiring bank balance from your mobile phone @Coopbankenya still charges you 20 bob. Nilitoka equity kwa frauds nikaenda coop kwa smooth robbery operators. Surely, ni bank gani hii kenya favorable for us poor peasants!!

— George T. Dianoh™ (@georgediano) March 3, 2022